How To Open a Wise Account and Transfer Money: All You

Need to Know

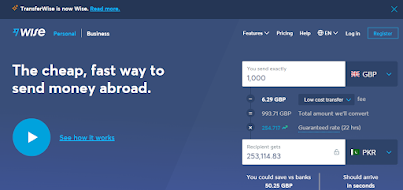

The money transfer

platform Wise, formerly TransferWise, offers an easy, cheap, and transparent

way to send money abroad.

Below, you will find

how you can open an account and send money using Wise.

What Do You Need To Start?

In the next section,

I’ll delve into a step-by-step process of opening a Wise account. But before

that, you should know that you need to already have a bank account open in

order to be able to use Transferwise.

Opening

a Wise Account: Step By Step Guide

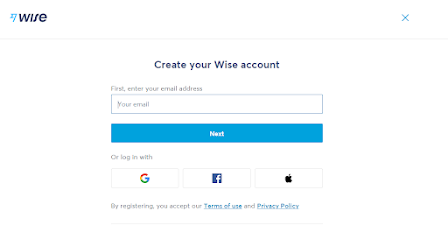

Step 1

Go to transfer wise website

Step 2

Select “Register”

Enter Email or direct connect to gmail

Step 4

Enter your email address, create a password, and select your

country of residence

Step 5

Fill out the required personal information, and voila!

The system will send you an

email with a security code or link in order to verify your contact information.

How To Send Money With Wise?

Once you registered

with Wise, access the website and log in.

Choose the amount you want to send abroad

At this stage, you’ll know the currency

exchange rate and what fee you will pay when the transfer is complete.

Add the beneficiary information and bank

account details

Make sure that you've put the correct details.

Verify your identity

The Wise platform will

send an SMS with a security code to your mobile phone.

At some cases, Wise

may request a copy of your identification document; all good, this is for the

safety of your funds.

Pay the transfer amount and the fee

Complete the transfer.

Track the status of your transfer

The beneficiary party

will receive a notice that the money is being transferred.

The transfer can take

anything from 1 to 2 business days to reach its destination, depending on the

date of deposit and the type of transfer you used.

What Are the Fees for Transferring Money With

Wise?

Wise provides its

users with the commercial exchange rate, not the tourist exchange rate, which

is higher. So, the transfer rate can be almost 10 times lower than that of

traditional banks.

The fees that are

charged vary, depending on the amount you are sending, the currencies you’re

using, and the payment method you choose.

The good thing is, you

will always transparently see the fees and what they refer to on the simulation

page, when you are sending out money.

Wise Transfer Limit

There are limits to

how much you can send with Wise. The limits depend on the currencies you send

to and from, as well as the method you use to pay. The platform will

notify you if you try and send above the limit.

Wise Multi Currency Account

If you are living

abroad or moving abroad, the Wise Multi Currency account may be right for you.

The account lets you

obtain international bank details and thus receive money worldwide, send money

to more than 80 countries, and convert your currency to more than 50

currencies. The bank details you obtain may belong to the United Kingdom,

Europe, the United States, Australia, or New Zealand.

You can either

register for this account at your initial registration or opt in for it later.

Wise will ask you to submit some documents for verification.

Wise Multi Currency Account Fees

There is no monthly

fee for the multi currency account. Fees are built into the features.

The currency

conversion is performed with the exchange rate of the day. The tariff is

typically between 0.35% and 2% depending on the currency. You can

withdraw up to €200 every month for free from ATMs all around the world. There

is a fixed fee of €0.60 to transfer money from your account to another account

with the same currency.

Wise Debit Card

Wise also offers a

MasterCard debit card, which is currently only available to the users that live

in the European Economic Area (EEA). You can use the card to make withdrawals

or payments.